MyFastBroker Deposit Methods (Fees + Limits): Full 2025 Guide

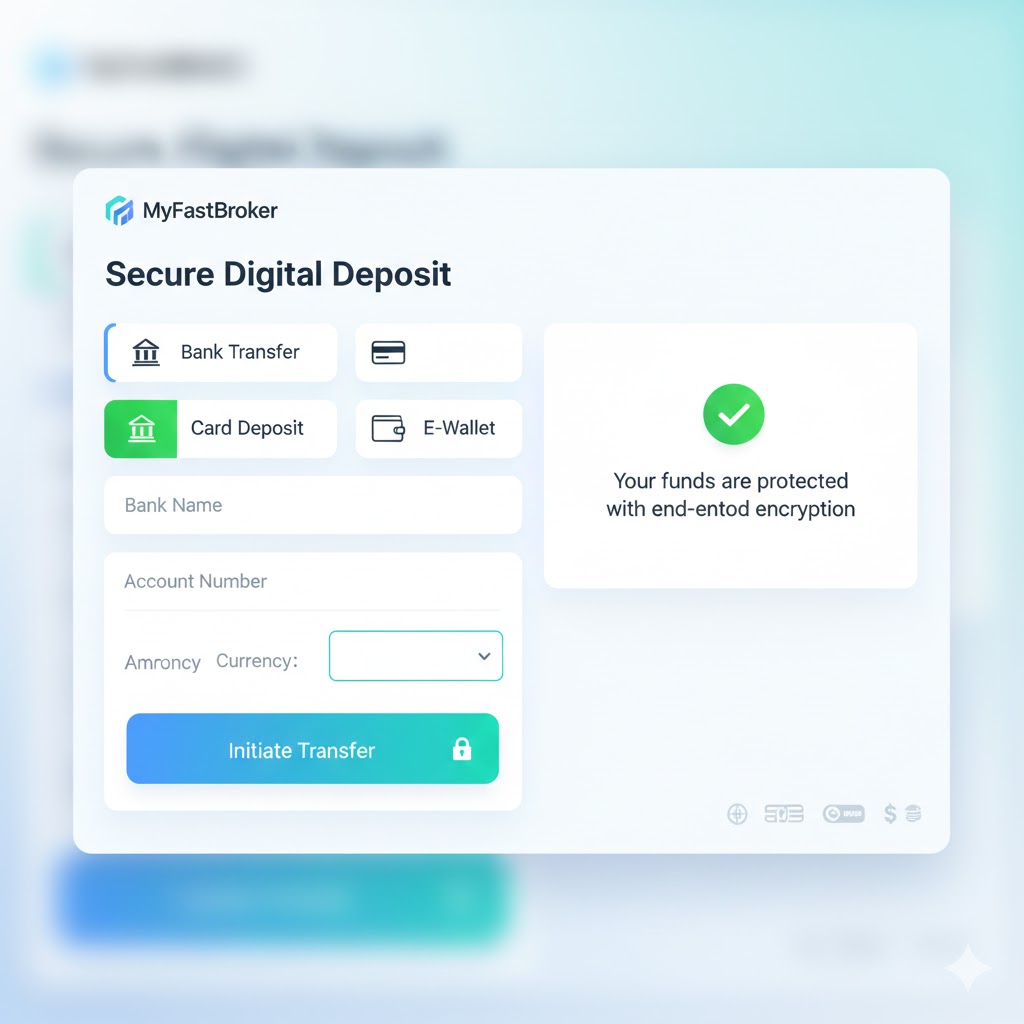

MyFastBroker gives users simple and fast ways to add money to their accounts. You can fund your user accountthrough different deposit methods. These methods include bank transfers, credit cards, debit cards, and e-wallets. Each method has its own deposit fees, processing time, and transaction limits. This guide explains all details with clear steps and short sentences. You learn everything you need for smooth MyFastBroker deposits.

Online deposits require smart decisions. You deal with financial transactions, so you need exact and honest information. You also need safe habits. Guides from trusted sources like the Federal Trade Commission, Google Safety Center, and Norton Cyber Safety help users understand safe online payments. You can use their advice while making deposits on MyFastBroker.

This full guide explains common reasons why MyFastBroker is not working, including payment failures, deposit errors, delays, and when to contact the support team.

Understanding MyFastBroker Deposits

MyFastBroker allows users to add money into their account balance. This balance helps you use different services on the platform. The deposit process stays simple because the platform uses a modern payment gateway. The gateway keeps your transaction secure and fast. You see clear options when you open the deposit menu.

The MyFastBroker system checks each transaction through a built-in security check. This prevents fraud and protects your money. You also receive updates on your transaction status after you complete your deposit. The dashboard shows every detail in one place.

Deposits help buyers, sellers, and investors stay ready for deals. Funds in your account help you act faster when a good opportunity appears.

Why Users Add Money to MyFastBroker

People add money for simple reasons:

- They want to pay platform fees.

- They want to boost their listings.

- They want to secure deals with faster actions.

- They want to prepare for future opportunities.

The platform never forces you to deposit money. You use the deposit option only when needed.

Your account balance shows all active funds. You can track all movements inside your dashboard.

Deposit Methods Available on MyFastBroker

The platform supports multiple payment options. You choose the method that matches your location and your bank rules.

These are the main deposit methods:

- Bank transfer

- Credit card

- Debit card

- E-wallets

- Other region-based methods

Each method follows strict fraud prevention guidelines. These rules match global financial safety standards.

Bank Transfer Deposits

A bank transfer is one of the most trusted options. Many users prefer this method because it supports higher transaction limits. It also works well for large amounts.

You start the transfer through your bank app or your online banking system. You send money from your bank to the platform’s account. You receive confirmation inside your dashboard after the transfer clears.

The processing time depends on your bank. Some banks take a few hours. Some take up to one business day.

The Federal Reserve notes that bank transfers stay safe when users double-check account numbers before sending. Always follow this recommendation.

Credit Card Deposits

A credit card deposit works fast. Many users choose this method for small or mid-range deposits. You enter your card details in the secure payment window. The payment gateway protects your card data.

Credit card deposits usually clear within seconds. The processing time stays short because the platform checks your card with real-time tools.

You might see small deposit fees depending on your bank. These fees come from your card provider, not the platform.

Credit cards also offer strong safety tools. Visa, Mastercard, and other networks follow rules from the Payment Card Industry Security Standards Council, which protects cardholders from fraud.

Debit Card Deposits

A debit card deposit feels similar to a credit card deposit but uses your bank balance. The process stays simple. You enter your card number, expiry date, and security code. The system checks the card through the authentication system.

Debit card deposits clear quickly. You see your updated account balance within minutes. Some banks charge small fees, but these fees depend on your region.

Debit cards support moderate transaction sizes. Many users prefer this method for daily activity.

E-Wallet Deposits

E-wallets give users a fast and flexible way to deposit. They offer convenient access for users who prefer digital wallets over bank cards. Some popular options include PayPal, Skrill, and regional wallets.

E-wallet payments stay quick because they use digital authorization. You log in to your wallet, confirm the amount, and the platform updates your balance after the transfer time completes.

You may see small deposit fees depending on the wallet you use. These fees are common in digital wallet systems.

Most e-wallets follow safety guidelines from the Electronic Transactions Association, which improves fraud protection.

Other Supported Payment Options

Some regions offer extra methods. These may include:

- Local bank apps

- Local payment channels

- Special merchant gateways

These methods follow the same rules for safety. They support different currency options and can help users in specific countries.

Minimum Deposit Requirements

Each method supports a different minimum deposit. Small minimums help new users test the platform. You can start small and increase later when you feel comfortable.

Your minimum amount shows on the deposit screen. The platform updates this number based on your region.

Maximum Deposit Limits

Your maximum deposit depends on your account type and your verification level. Basic accounts have small limits. Verified accounts have higher limits.

The platform checks your KYC status before increasing your limit. This aligns with global banking laws.

KYC rules come from agencies like FinCEN and FATF, which guide safe online financial activity.

Processing Time for Each Deposit Method

Each method has its own timeline. Here’s a simple breakdown:

- Bank transfer: Hours to one business day

- Credit card: Seconds to minutes

- Debit card: Seconds to minutes

- E-wallets: Seconds to minutes

- Local methods: Vary by region

The platform checks each deposit through a quick security check. This step protects your funds and stops unauthorized activity.

Currency Options

The platform supports several currency options. The available currencies depend on your country. You see your supported options during your deposit.

Some banks charge small conversion fees. You must check your bank rules for exact amounts.

Verification Requirements Before Depositing

You must complete verification requirements before making large deposits. This includes:

- Identity document

- Address proof

- Phone verification

- Email verification

These checks match global KYC laws. They help reduce fraud and protect users.

You update these documents from your dashboard. Your status appears under the verification tab.

Understanding the Funding Process

The funding process stays simple:

- Choose a deposit method

- Enter the amount

- Follow the payment instructions

- Wait for transaction status update

- Check your account balance

- Start your activity on the platform

Every step includes clear guidance. You do not need special skills.

How to Make a Deposit on MyFastBroker

Follow this simple guide:

- Log in to your MyFastBroker account

- Open the deposit menu

- Choose your preferred method

- Enter the amount

- Confirm the deposit

- Check your dashboard for updates

Your transaction updates appear in the history tab. You see the time, amount, and method used.

Deposit Fees Explained

Deposit fees depend on your payment method. The platform tries to keep fees low. Most fees come from banks or digital wallet providers.

Here’s a basic idea:

- Bank transfer: Often low

- Credit card: Depends on your bank

- Debit card: Usually low

- E-wallets: Depends on the wallet

- Local methods: Vary

Always check your method before depositing.

Fraud Prevention and Safety Checks

MyFastBroker uses multiple safety layers:

- Data encryption

- Real-time fraud checks

- Device recognition

- Identity verification

- Secure payment gateway

These tools match global safety standards shared by Norton, Google Safety, and FTC guidelines.

You also receive alerts when your transaction status changes.

Common Deposit Problems

Some users face issues during deposits. Here are common problems:

- Deposit declined

- Wrong card details

- Bank blocks online transactions

- Slow bank transfer

- Unsupported currency

- Verification incomplete

- E-wallet app issue

You fix most issues with simple steps.

Fixes for Deposit Errors

Use these quick fixes:

- Check your card details

- Enable online payments

- Try another payment method

- Check your KYC status

- Clear your browser cache

- Update your e-wallet

- Use a stable connection

- Call your bank if they block the payment

If nothing works, contact the support team.

When to Contact the Support Team

Reach out to the support team if:

- Your deposit does not show

- Your bank confirms the charge, but the platform does not

- Your wallet payment fails

- Your transfer gets delayed

- You see repeated errors

- You cannot pass verification

You can reach them through the help center. They respond quickly and offer clear solutions.

Tracking Your Transaction Status

Your dashboard shows all transaction details. You can see:

- Method used

- Time

- Amount

- Status

- Reference number

You can also download your records if needed. This helps with budgeting or financial planning.

How MyFastBroker Keeps Deposits Safe

Your deposits stay safe because the platform uses:

- Modern encryption

- Strong authentication

- Real-time monitoring

- KYC rules

- Fraud detection tools

- Safe payment channels

- Secure servers

These tools meet global online safety standards.

Tips for Safe Deposits

Follow these tips:

- Use your own device

- Keep your wallet password private

- Use updated apps

- Avoid public Wi-Fi

- Check your dashboard after every deposit

- Set up two-step verification

These tips come from reliable sources like Norton and FTC consumer guides.

Final Thoughts

MyFastBroker gives users a clean and fast system for deposits. You can use bank transfers, credit cards, debit cards, e-wallets, or local methods. Each method has clear fees, limits, and processing times. You see everything from the deposit screen. You also track each transaction status from your dashboard.

You learned how to make deposits, how to fix errors, how to pass verification, and how to keep your funds safe. With this knowledge, you can use the platform with confidence. Your deposits stay secure, and your activity remains smooth.

FAQs

1. Which deposit methods does MyFastBroker support?

You can use bank transfers, credit cards, debit cards, e-wallets, and local payment channels.

2. Does MyFastBroker charge deposit fees?

Some methods have small fees. Banks or wallets usually charge them.

3. What is the minimum deposit?

The minimum deposit depends on your method and region.

4. What is the maximum deposit limit?

Your limit increases after KYC verification.

5. How long does a deposit take?

Cards and e-wallets clear fast. Bank transfers take longer.

6. Why is my deposit not showing?

Check your transaction status. Slow banks or wrong details cause delays.

7. Do I need verification before large deposits?

Yes. You must complete KYC for higher limits.

8. Is it safe to deposit money on MyFastBroker?

Yes. The platform uses encryption, fraud checks, and a secure payment gateway.

9. What if my card deposit fails?

Check your bank settings, card limits, or try another method.

10. When should I contact support?

Contact the support team if your deposit stays pending or fails repeatedly.